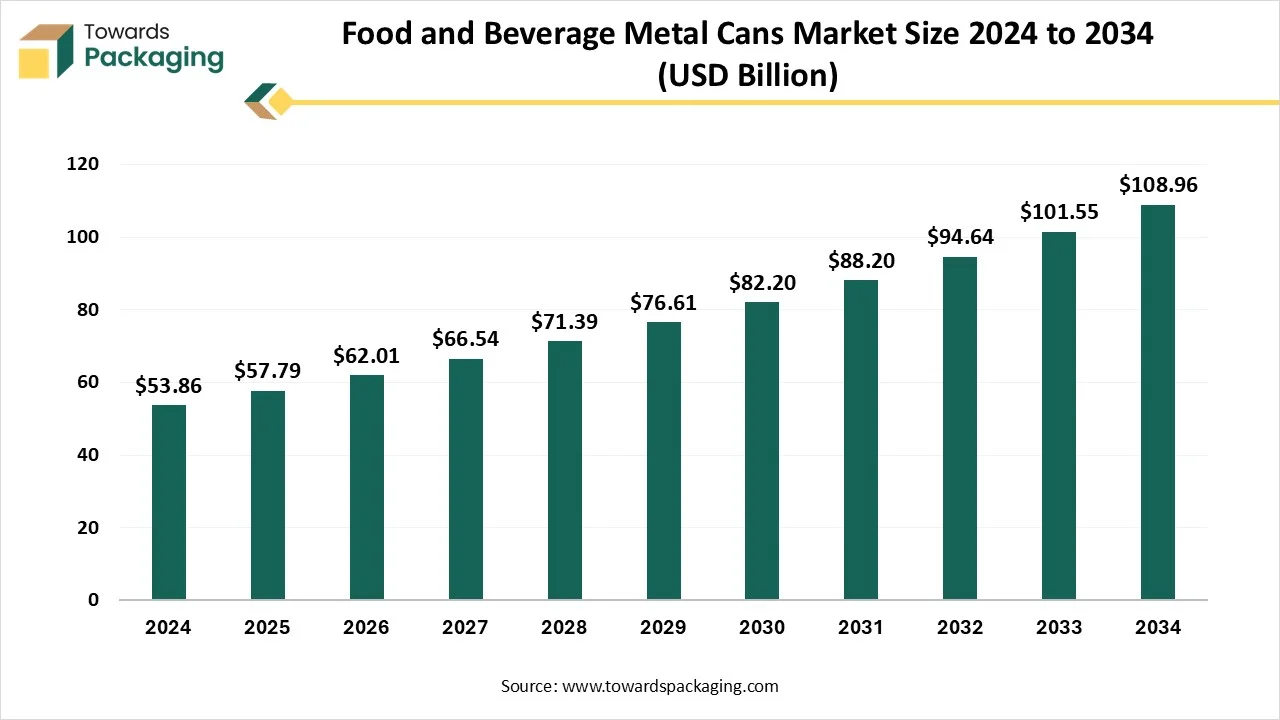

Food and Beverage Metal Cans Market Worth USD 108.96 Bn by 2034

According to Towards Packaging consultants, the global food and beverage metal cans market size is projected to reach approximately USD 108.96 billion by 2034, increasing from USD 62.01 billion in 2026, at a CAGR of 7.3% during the forecast period 2025 to 2034.

Ottawa, Sept. 16, 2025 (GLOBE NEWSWIRE) -- The global food and beverage metal cans market size reached approximately USD 57.79 billion in 2025, with projections suggesting it will climb to USD 108.96 billion in 2034, according to a report from Towards Packaging, a sister firm of Precedence Research. The market is witnessing steady growth driven by increasing demand for sustainable, recyclable, and convenient packaging solutions. Rising consumer preference for ready-to-drink beverages, canned foods, and energy drinks supports market expansion.

Advancements in lightweight can designs and extended shelf-life benefits further enhance adoption. North America dominates the market due to high consumption of packaged beverages, strong recycling infrastructure, and well-established food processing industries. Additionally, growing awareness of eco-friendly packaging fuels regional and global growth opportunities.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5751

What is Meant by Food and Beverage Metal Cans?

Food and beverage metal cans refer to rigid, sealed containers made primarily of aluminum or steel, designed to package and preserve consumable products such as soft drinks, energy drinks, beer, juices, canned vegetables, soups, and ready-to-eat meals. These cans provide durability, tamper resistance, and extended shelf life while maintaining the taste, freshness, and nutritional value of the contents.

They are widely valued in the packaging industry for their lightweight structure, stackability, and high recyclability, aligning with sustainability goals. Their use enhances product convenience, branding visibility, and distribution efficiency, making them a preferred choice for manufacturers and consumers worldwide.

What are the Latest Trends in the Food and Beverage Metal Cans Market?

- Sustainability and lightweighting: Manufacturers are reducing can weight, using more recycled aluminum, developing BPA-free or water-based coatings, and improving recyclability.

- Smart & functional packaging: QR codes, NFC/RFID, freshness indicators, and advanced quality control via AI and automation are being integrated.

- Ready-to-drink & convenience formats: Smaller portion sizes, portion-controlled cans, on-the-go packaging, and demand for RTD beverages are pushing growth.

- Premiumization & visual differentiation: Brands are focusing on high-definition printing, striking designs, embossing, and specialized coatings to differentiate products on the shelf.

-

Regulatory pressures & tariff impacts: Steel/aluminum import tariffs are raising material costs; regulations around recycled content and food-safe coatings are influencing sourcing and product design.

If there is anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What Potentiates the Growth of the Food and Beverage Metal Cans Market?

Rising beverage consumption and packaging innovation are key growth levers for the metal can market. Increasing demand for on-the-go, ready-to-drink (RTD) beverages like energy drinks, teas, soft drinks, and even alcoholic cocktails is pushing manufacturers to favour metal cans for their convenience, durability, and superior preservation of flavor and freshness. Innovation further accelerates growth: companies are introducing lightweight aluminium cans, advanced coatings, smart packaging features like QR/NFC codes, and digital printing techniques to improve brand differentiation and sustainability.

Recent developments in 2025 include the U.S. imposing a 50% tariff on aluminum and steel imports, which has raised raw‐material costs but also encouraged the use of recycled aluminum, a move that helps can makers who use high proportions of recycled material. Also, partnerships like the one between HBTU (Kanpur) and Mercury Industries to develop better can coatings and inks show the push toward innovation to meet regulatory, aesthetic, and functional demands.

Limitations & Challenges in the Food and Beverage Metal Cans Market

The key players operating in the market are facing issues due to environmental concerns and competition from alternative packaging. Though recyclable, the energy-intensive production of aluminum raises carbon footprint issues. The rising popularity of PET bottles, pouches, cartons, and biodegradable plastics limits the demand for metal cans.

Regional Analysis:

Who is the Leader in the Food and Beverage Metal Cans Market?

North America dominates the food and beverage metal cans market due to its high consumption of packaged beverages such as carbonated soft drinks, beer, and energy drinks, coupled with strong demand for canned food products. The region has a well-established food processing industry and a highly efficient recycling infrastructure that supports the widespread use of aluminum and steel cans.

Consumer preference for sustainable and convenient packaging further strengthens the market position. Additionally, continuous innovation in lightweight designs, premium printing, and BPA-free coatings by leading manufacturers based in the U.S. and Canada enhances regional growth and market leadership.

U.S. Market Trends

The U.S. leads the food and beverage metal cans market with strong demand for carbonated drinks, craft beer, energy drinks, and ready-to-eat canned foods. A robust packaging industry, the presence of major can manufacturers, and advanced recycling systems ensure high adoption rates. Growing consumer preference for sustainable, lightweight, and portable packaging supports market expansion.

Regulatory pressure to increase recycled content has encouraged innovations in eco-friendly cans. Additionally, premiumization in beverage packaging and widespread investment in digital printing and design customization further solidify the U.S. as the key driver of growth within North America.

Canada Market Trends

Canada’s market is driven by rising consumption of ready-to-drink beverages, canned soups, and preserved foods, supported by increasing urbanization and busy lifestyles. Strong environmental awareness and government emphasis on circular economy practices boost demand for recyclable packaging solutions like aluminum cans.

Beverage brands are increasingly adopting lightweight and BPA-free can technologies to align with health and sustainability trends. Local breweries and specialty beverage producers also favour cans for cost efficiency and brand visibility. This combination of eco-conscious consumer behavior and innovation positions Canada as a steadily expanding market within North America.

More Insights of Towards Packaging:

- Europe Fresh Food Packaging Market Driven by 3.63% CAGR - The Europe fresh food packaging market is set to grow from USD 35.93 billion in 2025 to USD 49.52 billion by 2034.

- Food Cans Market Dynamics, Competitive Forces and Strategic Pathways - The global food cans market is poised for steady growth, expected to increase from USD 4.16 billion in 2025 to USD 7.49 billion by 2034.

- Food Packaging Equipment Market Strategic Analysis & Growth Opportunities - The food packaging equipment market is projected to reach USD 36.05 billion by 2034, expanding from USD 22.57 billion in 2025.

- Compostable Tableware Market Strategic Analysis and Growth Opportunities - The compostable tableware market is forecasted to expand from USD 11.55 billion in 2025 to USD 17.37 billion by 2034.

- Seafood Packaging Market Insights & Forecast | USD 27.12 Billion Opportunity Ahead - The global seafood packaging market size reached USD 15.58 billion in 2024 and is projected to hit around USD 27.12 billion by 2034.

- Food Service Packaging Market Key Players, Segments | Growth - The global food service packaging market is forecasted to expand from USD 104.54 billion in 2024 to attain a calculated USD 177.49 billion by 2034.

- Baby Food Packaging Market Value to Nearly Double to USD 149.12 Billion by 2034 at 7.6% CAGR - The baby food packaging market size is forecasted to expand from USD 77.13 billion in 2025 to USD 149.12 billion by 2034.

- Milk Packaging Market 2025 Driven by Eco-Friendly Trends to Reach USD 81.35 Billion by 2034 - The global milk packaging market is anticipated to grow from USD 53.58 billion in 2025 to USD 81.36 billion by 2034.

- PFAS-Free Food Packaging Market Set for 6.55% CAGR from 2025 with Demand from QSR and Retail Sectors - The global PFAS-free food packaging market is expected to increase from USD 48 billion in 2025 to USD 84.96 billion by 2034.

- Flexible Packaging for Beverage Market 2025 Asia Pacific Leads with 36% - The flexible packaging for beverage market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034.

How is the Opportunistic Rise of the Asia Pacific in the Food and Beverage Metal Cans Market?

The Asia-Pacific region is growing at the fastest rate in the food and beverage metal cans market due to rapid urbanization, rising disposable incomes, and changing dietary habits that increase demand for packaged and ready-to-drink products.

Expanding middle-class populations in countries like China, India, and Southeast Asia are driving the consumption of soft drinks, energy drinks, and canned foods. Additionally, growing awareness of sustainability, along with investments by global and regional manufacturers in lightweight and innovative can designs, further accelerates market expansion across the region.

China Market Trends

China represents the largest market in Asia-Pacific for food and beverage metal cans, fueled by high consumption of soft drinks, beer, and canned foods. Rapid urbanization and a growing middle class are driving demand for convenient and portable packaging solutions.

Government policies promoting recycling and sustainability can further support adoption. International and domestic beverage brands are heavily investing in innovative designs and eco-friendly cans. Additionally, the expansion of e-commerce platforms boosts demand for durable packaging formats like metal cans.

India Market Trends

India’s food and beverage metal cans market is expanding rapidly due to rising urbanization, growing disposable incomes, and increasing youth preference for energy drinks, carbonated beverages, and canned juices. The convenience of ready-to-drink packaging appeals to busy lifestyles, while heightened awareness of hygiene and product safety post-pandemic accelerates demand.

Though plastic packaging remains strong, sustainability initiatives and recycling awareness are gradually increasing metal can adoption. Investments by global players in local production facilities are further driving growth in the Indian market.

Japan Market Trends

Japan’s market is driven by high consumption of canned coffee, tea, alcoholic beverages, and ready-to-eat foods. The country has an advanced recycling system and strong consumer awareness of sustainability, making aluminum cans highly preferred. Innovations in packaging design, such as resealable cans and premium printing, enhance product differentiation.

Established beverage brands continue to rely on cans for their durability, convenience, and preservation qualities. Moreover, the country’s mature food processing industry supports steady and consistent demand for metal cans.

South Korea Market Trends

South Korea shows strong growth in the food and beverage metal cans market due to high consumption of functional drinks, carbonated beverages, and alcoholic drinks like beer and soju. Rising health consciousness has spurred demand for energy and vitamin drinks, often packaged in cans.

The countries advanced recycling infrastructure and eco-conscious consumers support sustainable packaging adoption. Beverage companies are increasingly adopting innovative designs, lightweight cans, and premium graphics to attract young consumers. E-commerce expansion and demand for portable, ready-to-drink products further boost market growth.

How Big is the Success of the European food and Beverage Metal Cans Market?

Europe is witnessing notable growth in the food and beverage metal cans market due to its strong focus on sustainability and circular economy practices. The region has one of the most advanced recycling infrastructures, making aluminum and steel cans a preferred packaging option.

Rising demand for premium beverages, including craft beer, wine, and energy drinks, further drives adoption. Additionally, innovation in packaging designs, lightweight materials, and BPA-free coatings supports market expansion while aligning with evolving consumer preferences for eco-friendly and convenient solutions.

How Crucial is the Role of Latin America in the Food and Beverage Metal Cans Market?

Latin America is growing at a considerable rate in the food and beverage metal cans market due to increasing consumption of carbonated soft drinks, beer, and ready-to-drink beverages, particularly among younger demographics. Urbanization and rising disposable incomes are fueling demand for convenient, portable, and long-lasting packaging solutions.

Strong regional beer culture, especially in countries like Brazil and Mexico, supports higher adoption of metal cans. Additionally, growing awareness of sustainability and gradual improvement in recycling infrastructure are encouraging the shift toward recyclable aluminium packaging.

How does the Middle East and Africa Impact the Food and Beverage Metal Cans Market?

The growth opportunity for the market in the Middle East and Africa is considerable, supported by rising consumption of carbonated soft drinks, energy drinks, and canned foods among the region’s young and urban population. Increasing disposable incomes and a shift toward convenient, ready-to-drink packaging formats are fueling demand.

Moreover, growing investments in sustainable packaging and gradual improvements in recycling infrastructure are creating long-term opportunities. International beverage companies expanding their presence in the region further enhance market growth potential.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Material Type Insights

The aluminum cans segment dominates the food and beverage metal cans market due to its lightweight, corrosion-resistant, and highly recyclable properties. Aluminum cans preserve flavor and freshness, making them ideal for carbonated drinks, beer, and energy beverages. Their cost-effectiveness, ease of transport, and strong alignment with sustainability goals further strengthen their widespread adoption by manufacturers and consumers globally.

The steel cans segment is the fastest-growing in the market due to its superior strength, durability, and cost-effectiveness in packaging products like soups, vegetables, fruits, and pet food. Steel provides excellent protection against light and air, extending shelf life and ensuring product safety.

Growing demand for affordable, long-lasting packaged foods in emerging economies, coupled with advancements in lightweight steel can manufacturing and increasing recycling initiatives, further supports the rapid adoption and expansion of this segment.

Product Type Insights

The beverage cans segment dominates the food and beverage metal cans market due to the high global demand for carbonated soft drinks, energy drinks, beer, and ready-to-drink beverages. Beverage cans offer excellent preservation of flavor, freshness, and carbonation, while being lightweight, portable, and tamper-resistant.

Their recyclability and alignment with sustainability initiatives make them preferred by environmentally conscious consumers. Additionally, innovations in can design, premium printing, and coatings enhance brand appeal, driving widespread adoption across both developed and emerging markets.

Distribution Channel Insights

The retail sales segment dominates the distribution channel in the food and beverage metal cans market due to its extensive reach and accessibility to consumers. Supermarkets, hypermarkets, convenience stores, and specialty retailers provide wide product visibility and facilitate bulk and on-the-go purchases. Retail channels support brand promotions, premium packaging display, and consumer engagement, enhancing sales.

Additionally, the growth of organized retail infrastructure, coupled with urbanization and rising disposable incomes, reinforces the dominance of retail outlets as the primary distribution route for metal cans.

The online sales segment is the fastest-growing distribution channel in the market due to increasing consumer preference for convenience and home delivery. E-commerce platforms, including B2C and B2B marketplaces, offer easy access to a wide variety of beverages and canned foods, often with attractive promotions and subscription options.

Growing internet penetration, smartphone usage, and digital payment adoption accelerate online purchases. Additionally, the COVID-19 pandemic has shifted consumer behavior toward online shopping, while brands leverage digital marketing, direct-to-consumer strategies, and rapid logistics to expand reach and drive sales growth in the metal cans market.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Can Size Insights

The medium can (250-500ml) segment dominates the food and beverage metal cans market due to its optimal balance between portability, convenience, and portion size, making it ideal for soft drinks, energy drinks, beer, and ready-to-drink beverages. It caters to individual consumption while maintaining cost efficiency for manufacturers and retailers.

The medium size also supports efficient storage, transportation, and shelf display. Growing consumer preference for on-the-go products and the versatility of medium cans for branding and promotional designs further reinforce their dominance in the market.

The small can (under 250 ml) segment is the fastest-growing in the market due to increasing demand for portion-controlled, on-the-go beverages such as energy drinks, carbonated soft drinks, and specialty drinks. Consumers favour smaller cans for convenience, calorie control, and easy portability, especially in urban and working populations.

Beverage manufacturers leverage small cans for product sampling, premium launches, and targeted marketing campaigns. Additionally, rising health awareness and the popularity of single-serve packaging further accelerate the adoption and growth of small-sized metal cans.

Functionality Insights

The easy-open cans segment dominates the food and beverage metal cans market due to its enhanced consumer convenience and user-friendly design. Featuring pull-tabs or stay-on lids, these cans allow quick, safe, and mess-free access without additional tools, making them ideal for beverages like soft drinks, beer, and energy drinks. Their widespread adoption is driven by growing on-the-go lifestyles, retail and vending channel preferences, and the ability to improve brand appeal through premium designs, ensuring consistent demand and strong market dominance.

Can Type Insights

The tinplate cans segment dominates the food and beverage metal cans market due to its durability, corrosion resistance, and excellent barrier properties that protect food and beverages from contamination and spoilage. Widely used for canned vegetables, fruits, soups, and ready-to-eat meals, tin plate cans ensure long shelf life and product safety.

Their cost-effectiveness, ease of mass production, and adaptability to various food applications make them highly preferred by manufacturers, while recyclability supports sustainability goals, reinforcing their dominant market position.

Coating Type Insights

The lacquer-coated cans segment holds a significant position in the food and beverage metal cans market due to its protective coating that prevents corrosion and chemical reactions between the can and contents. Lacquer coatings preserve flavor, freshness, and nutritional quality, making them ideal for beverages, canned foods, and ready-to-eat products.

Their ability to enhance product safety, extend shelf life, and support compliance with food-grade regulations drives adoption. Additionally, lacquer coatings enable high-quality printing and branding, strengthening manufacturer preference and consumer appeal.

Access our exclusive, data-rich dashboard dedicated to the Food and Beverage Metal Cans Market- built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access Now: https://www.towardspackaging.com/contact-us

Recent Breakthroughs in the Global Market:

- In August 2025, Novelis, a world leader in aluminum rolling and recycling and a leading provider of sustainable aluminum solutions, announced that it had signed a joint development agreement with DRT Holdings, LLC ("DRT") to expedite the use of high-recycled-content alloys in aluminum beverage can ends. The goal of this partnership is to enhance the production process for sustainable can ends, ensuring smooth adoption throughout the global metal packaging industry.

- In September 2025, according to local economic development officials, Red Bull, an energy drink manufacturer, and two partner companies are finally beginning construction on new beverage and packaging facilities in North Carolina. This week, construction was scheduled to begin for Red Bull, Rauch North America, and Ball Corp on their individual initiatives at a business park outside of Charlotte.

Global Food and Beverage Metal Cans Market Companies

- Ball Corporation

- Crown Holdings, Inc.

- Ardagh Group

- Can-Pack S.A.

- Tata Steel Limited

- BWAY Corporation

- Alcoa Corporation

- Silgan Containers

- Sonoco Products Company

- Amcor Limited

- General Steel Industries, Inc.

- Toyobo Co., Ltd.

- Rexam

- WestRock Company

- Mueller Industries, Inc.

- SAB Miller

- Constellium N.V.

- Tinplate Company of India Ltd.

- Zhejiang Materials Industry Group Corp.

- China National Petroleum Corporation

Global Food and Beverage Metal Cans Market

By Material Type

- Aluminum Cans

- Steel Cans

By Can Type

- Tinplate Cans

- Aluminum Cans

By Product Type

- Beverage Cans

- Soft Drink Cans

- Beer Cans

- Energy Drink Cans

- Fruit Juice Cans

- Food Cans

- Vegetable Cans

- Fruit Cans

- Meat Cans

- Ready-to-Eat Meal Cans

By Can Size

- Small Cans (Under 250 ml)

- Medium Cans (250-500 ml)

- Large Cans (Above 500 ml)

By Coating Type

- Lacquer Coated Cans

- Non-Lacquer Coated Cans

By Functionality

- Easy-Open Cans

- Standard Cans

By Distribution Channel

- Online Sales

- Retail Sales

- Direct Sales

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5751

Become a Valued Research Partner with Us - Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals - Explore the Coverage:

- Flexible Packaging Market - PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

-

Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight - Check It Out:

- Beverage Carton Packaging Machinery Market - 2025 Update Shows Leadership by Tetra Pak SIG and Other Global Players

- Corrugated Box Packaging for Food and Beverages Market - 2025 Asia Pacific Leads with 38 Percent Share

- Single-Use Packaging Alternatives Market - Food & Beverage Sector Holds 46% Share as E-Commerce Adoption Rises

- Circular Packaging Market - Food & Beverage Leads, Cosmetics Packaging Booms

- Recyclable Beverage Packaging Market - Trends, Challenges, Strategic Recommendations & Key Players

- Sustainable Plastic Packaging Market - Why Food & Beverage Brands Are Going Green

- Plastic Container Market 2025 - Driven by PET and Beverage Demand with Strong Growth Forecast

- Recycled PET Bottles Market - 2025 Driven by Clear Type Segment and Food and Beverage Industry Leadership

- Plastic Packaging for Food and Beverage Market - Performance, Trends and Strategic Recommendations

- Beverage Packaging Machine Market - Direct Sales Outperform as Market Expands Globally

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.